change in net operating working capital formula

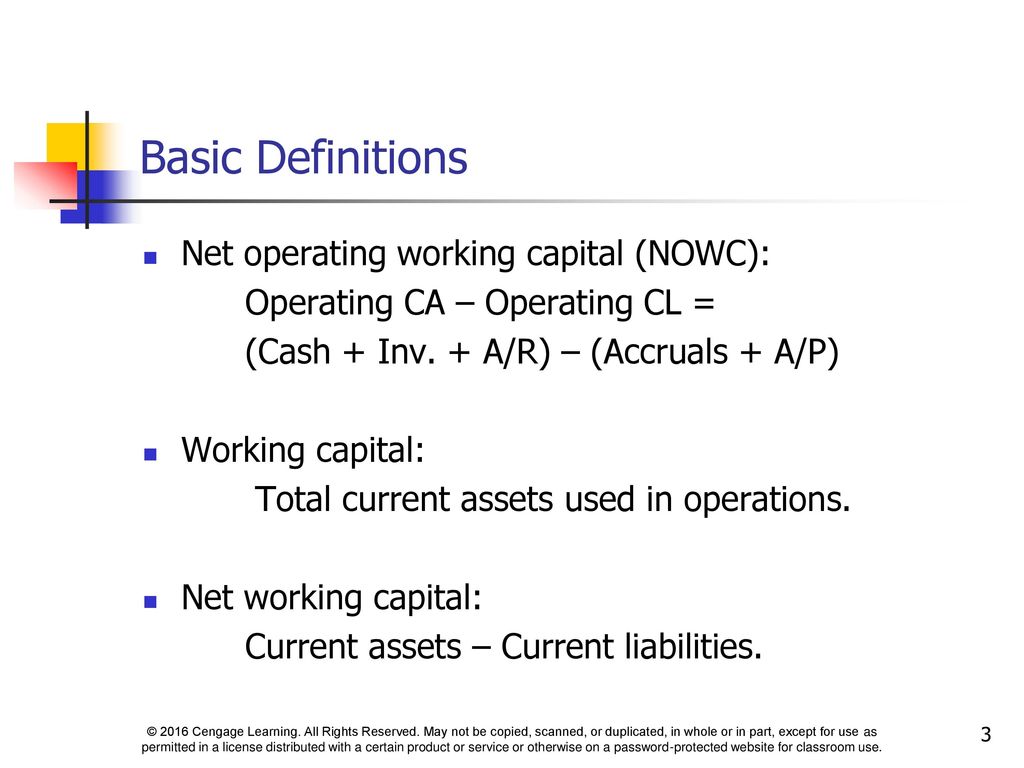

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. Working capital Working Capital Current Assets - Current Liabilities Cash conversion cycle.

Thus the formula for changes in non-cash working capital is.

. 2016 prior period. Remember that working capital current assets current liabilities. In other words the company is highly liquid and financially sound in the short term.

Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio. Net Working Capital Current Assets less cash Current Liabilities less debt or. Step 4 Capital Expenditures.

Alternatively it can be seen that the financing approach can also be used to calculate the Net Operating Assets. Changes in working capital is an idea that lives in the cash flow statement. Determine whether the cash flow will increase or decrease based on the needs of the business.

The goal is to. The definition of working capital shown below is simple. Working Capital to Sales Ratio Working Capital Sales.

Working capital is a balance sheet definition that only gives us a value at a certain point in time. Net Operating Working Capital Operating Current Assets Operating Current Liabilities 30678M 34444M -3766 million. Change in Net Working Capital Calculation Colgate.

To calculate your business net working capital NWC also known as net operating working capital NOWC subtract your total current liabilities from your total current assets. Depending on how detailed you or your analyst wants your working capital calculation to be you can choose from one of several different models. Change in Net Working Capital NWC Example Calculation Current Operating Assets 50mm AR 25mm Inventory 75mm Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm Net Working Capital NWC 75mm 60mm 15mm.

Net Working Capital Formula. Since XYZ ltd current assets exceeded the current liabilities the working capital of XYZ Ltd is positive. Stating the working capital as an absolute figure makes little sense.

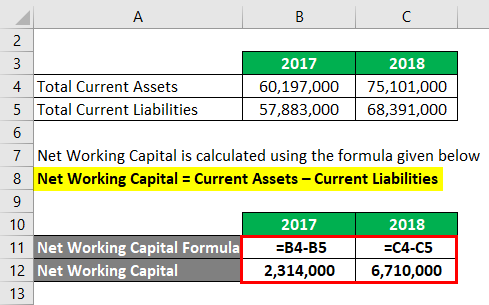

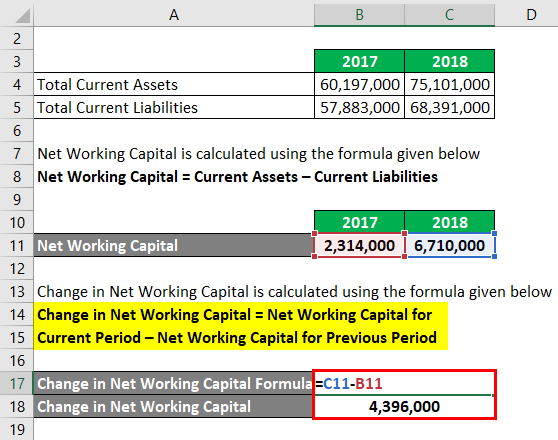

Calculate total net operating capital for Best. Net Working Capital Current Assets Current Liabilities. Lets understand how to calculate the Changes in the Net Working Capital with the help of an example.

This indicates that XYZ Ltd can pay all their current liabilities using only current assets. Net Operating Assets calculated using the financing approach have the following formula. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF.

So let us calculate the Net Working Capital for Microsoft for 2019-2020. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Working capital formula and definition.

Changes in Net Working Capital Formula Working Capital Current Year Working Capital Previous Year. Since the change in working capital is positive you add it back to Free Cash Flow. Typical current assets that are included in the net working capital calculation are cash accounts receivable.

Consider two companies both having the same working capital of USD 100. Working capital refers to a specific subset of balance sheet items. Calculate Changes in Net Working Capital using the formula below.

Net Working Capital Current Assets Current Liabilities 49433M 43625M 5808 million. Free cash flow equals net operating profit after taxes minus change in total net operating capital over the period. There would be no change in working capital but operating cash flow would decrease by 3 billion.

Calculate the change in working capital. Working capital Current assets current liabilities. Cash short term investments short term debt Working capital requirements are an investment WC.

Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP Where AR accounts receivable. AP accounts payable. Net Operating Assets Equity Short-term and Long-Term Non-Operating Debts Non-Current Operating Assets Financial Assets and investments Excess cash and.

Total Net Operating Capital Net Operating Working Capital Non-current Operating Assets. Cash Accounts Receivable Inventory Accounts Payable Accrued Expenses This calculation is tied much more closely to current cash flows than the equation to determine plain net operating capital because net working capital includes all of a companys current assets and liabilities. Here is what the basic equation looks like.

Changes in the Net Working Capital Change in Current Assets Change in the Current Liabilities. Net Operating Working Capital Operating Current Assets Operating Current Liabilities. 2017 current period.

Add or subtract the amount. Difference between Working Capital and Changes in Working Capital. The formula for calculating net operating working capital is.

Bill would calculate his NOWC as follows. A key part of financial modeling involves forecasting the balance sheet. 100000 20000 500000 300000 100000 220000.

The net working capital formula is calculated by subtracting the current liabilities from the current assets. Operating Working Capital OWC Operating Current Assets Operating Current Liabilities Key Learning Points Working capital is a measure of liquidity and calculated as current assets less current liabilities. Thats why the formula is written as - change in working capital.

This means that Bill could pay off all of his working liabilities with only a portion of his working assets. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. Imagine if Exxon borrowed an additional 20 billion in long-term debt boosting the current.

Net Working Capital 28000. Accounts Receivable Inventory Accounts Payable Other. Calculate Current Assets for The Current and Previous Year.

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Changes In Net Working Capital All You Need To Know

Working Capital What It Is And How To Calculate It Efficy

Supply Chains And Working Capital Management Ppt Download

Is A House An Asset Or Liability Online Accounting

What Is Net Working Capital How To Calculate Nwc Formula

Working Capital Example Formula

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Why You Need To Know The Working Capital Formulation And Ratio India Dictionary

Net Working Capital Template Download Free Excel Template

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Days Working Capital Formula Calculate Example Investor S Analysis

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)